Buying your first car is a thrilling experience, but figuring out how to pay for it can be a challenge!

In Nigeria, first-time buyers have several financing options to make car ownership more affordable and convenient. From traditional bank loans to flexible hire purchase agreements, let’s explore which option is best for your financial situation.

Whether you’re considering a new car or a Tokunbo vehicle, this guide will help you understand the most common financing choices available in 2025.

Bank Loans for Car Financing

When you are buying your first car, bank loans can offer a great way to spread out the cost, making it more manageable.

The idea of owning a car without paying for it upfront is appealing, especially for first-time buyers in Nigeria. But before diving in, it’s essential to understand how these loans work and what Nigerian banks offer.

Overview of Bank Loans for First-Time Car Buyers

A bank loan essentially allows you to borrow the money you need to purchase your car, and you pay it back over time, usually with interest. It’s a popular choice for first-time buyers who don’t have enough savings or don’t want to deplete their funds.

However, you need to ensure that you have a solid repayment plan in place. Missing payments can lead to penalties, and in extreme cases, you could even lose your car.

Loans typically cover both new and used cars (including Tokunbo models), but the terms of the loan might differ based on the type of car you want.

New cars often come with more favorable terms, while used cars, especially older Tokunbo models, may come with slightly higher interest rates because they are considered a higher risk by lenders.

Popular Nigerian Banks Offering Car Loan Services

Several Nigerian banks offer car loan products tailored specifically for car buyers. Some of the most popular options include:

- GTBank: Known for its convenient digital banking services, GTBank offers flexible loan terms with competitive interest rates. First-time buyers can apply online, making the process relatively smooth.

- Zenith Bank: Zenith Bank offers car loans with favorable interest rates and flexible repayment plans. They also provide pre-approved loans for eligible customers, streamlining the process.

- First Bank: As one of Nigeria’s oldest banks, First Bank has a strong reputation and offers car loans with various financing options, including lease options and loans for both new and used cars.

These banks typically have specific criteria for eligibility, such as proof of stable income, a good credit history, and sometimes a down payment.

Interest Rates, Loan Terms, and Eligibility Criteria

The interest rates on car loans in Nigeria can vary significantly depending on the bank and the type of vehicle.

For new cars, you might find rates ranging from 15-22% per annum, while Tokunbo cars often come with higher rates, up to 25% or more.

Loan terms generally range from 1 to 4 years, allowing buyers to choose a repayment plan that fits their budget.

Eligibility criteria usually include:

- Proof of stable monthly income (some banks require a minimum income threshold)

- A good credit history

- A down payment (typically 10-30% of the car’s price)

- Employment verification and bank statements

Pros and Cons of Bank Loans

Pros:

- Ownership: Unlike leasing, where you are renting the car, bank loans ensure you fully own the vehicle after repayment.

- Flexible terms: With different banks offering flexible repayment plans, you can choose a term that fits your financial situation.

- Wide availability: With various banks offering car loan services, you have plenty of options to compare and choose from.

Cons:

- Interest rates: The interest can add a significant amount to the overall cost of the car. For used cars, higher interest rates can make the loan more expensive than anticipated.

- Eligibility hurdles: Not everyone qualifies for a loan. If you don’t have a steady income or a good credit history, you may struggle to get approved.

- Hidden costs: Loans often come with fees like processing fees, insurance costs, and in some cases, a higher down payment for older cars.

In case you are interested in exploring more details about buying options and first-time car purchases, A Comprehensive Guide to Buying Your First Car in Nigeria (2025) and Affordable and Reliable Cars for First-Time Buyers in Nigeria (2025) would guide you.

Hire Purchase Financing

When you’re looking to buy a car but don’t want to take out a traditional loan, hire purchase can be a solid alternative.

It’s a financing method that allows you to spread the cost of the vehicle over a set period, making it more affordable, especially for first-time buyers in Nigeria.

But before jumping in, it’s important to understand how it works and whether it’s the right choice for you.

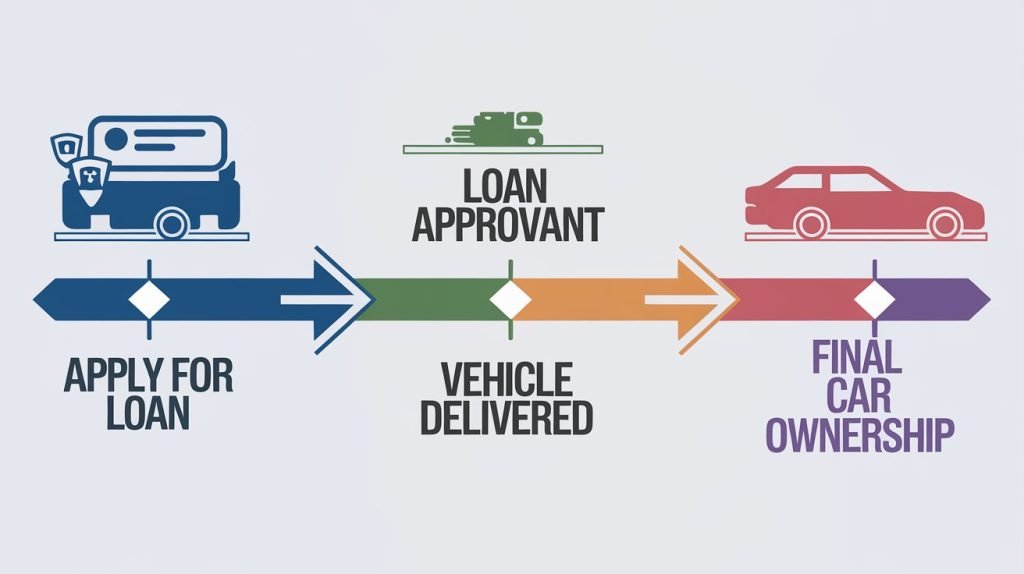

Explanation of Hire Purchase as a Financing Option

Hire purchase is essentially a payment plan where you agree to pay for the car in installments, typically on a monthly basis.

Unlike a loan, you don’t own the car outright from the beginning. Instead, the vehicle belongs to the seller (or a third-party finance company) until you’ve made the final payment.

Once the payments are complete, ownership of the car is transferred to you. It’s a bit like “renting to own.”

For many first-time buyers, this method is attractive because it doesn’t require the full cost of the car upfront, which is especially helpful if you’re buying a more expensive new car or even a well-maintained used (Tokunbo) car.

How Hire Purchase Works for New and Used Cars

The hire purchase process works similarly whether you’re buying a new or used car, but there can be some differences in the down payment and monthly payments based on the age and condition of the vehicle.

For new cars, hire purchase agreements often come with lower interest rates and more favorable terms. You can usually find this option available directly through car dealerships, where they partner with financial institutions to offer hire purchase plans.

For used or Tokunbo cars, the process is the same, but you may face higher interest rates or shorter repayment terms.

Some dealerships in Nigeria even specialize in hire purchase for Tokunbo cars, giving you flexibility in choosing a car that fits your budget.

Key Considerations: Down Payment, Ownership Transfer, Monthly Payments

When entering a hire purchase agreement, it’s important to keep a few key things in mind:

- Down Payment: Most hire purchase plans will require an initial down payment, which is typically 10-30% of the car’s total price. The larger the down payment, the lower your monthly payments will be.

- Ownership Transfer: As mentioned earlier, you don’t own the car until all payments are complete. This means if you miss too many payments, the seller or financier has the right to repossess the vehicle.

- Monthly Payments: You’ll need to budget carefully for your monthly installments, as they can add up quickly, especially if the repayment period is short. Missed payments can lead to penalties or even losing the car.

Be sure to clarify these details before signing any hire purchase agreement so you are fully aware of the costs and your obligations.

Pros and Cons of Hire Purchase for First-Time Buyers

Pros:

- No large upfront payment: This can be a lifesaver for first-time buyers who don’t have enough savings to cover the full cost of a car upfront.

- Flexible repayment terms: With a hire purchase agreement, you can usually negotiate the length of the payment period to fit your budget.

- Eventually own the car: Unlike leasing, where you return the car after a set period, hire purchase ensures that you will own the vehicle once all payments are complete.

Cons:

- Higher overall cost: While spreading the payments can be more manageable, the total cost of the car by the end of the hire purchase agreement may be higher than if you had paid for it outright due to interest and fees.

- No immediate ownership: The car technically belongs to the lender until the last payment is made, meaning you are not the legal owner during the repayment period.

- Risk of repossession: Missed payments can lead to the car being repossessed, leaving you without a vehicle and losing all the money you’ve already paid.

Car Leasing in Nigeria

If you’re a first-time car buyer in Nigeria, you might be exploring various options to get behind the wheel without committing to a hefty purchase.

Car leasing is an increasingly popular alternative that allows you to enjoy the benefits of a vehicle without the long-term financial commitment of buying one outright.

Let’s break down how car leasing works and what you need to know before diving in.

What is Car Leasing and How Does It Work?

Car leasing is essentially a long-term rental agreement where you pay to use a vehicle for a specific period—usually between two to four years.

Instead of buying the car, you’re essentially “renting” it for that duration. At the end of the lease term, you typically return the vehicle to the leasing company.

Here’s how it generally works: you choose a car, agree to a leasing contract, and make monthly payments that cover the car’s depreciation, interest, and fees. Unlike buying a car, you don’t own it at the end of the lease term.

This can be a great option for those who enjoy driving newer models or want to avoid the hassles of car ownership, like selling or trading in a vehicle later on.

The Leasing Process for First-Time Buyers

Getting started with car leasing as a first-time buyer involves several steps:

- Choose Your Vehicle: Decide on the type of car you want. Make sure to consider your lifestyle and how you plan to use the car.

- Understand the Contract: Leasing agreements can be a bit tricky. They typically outline the monthly payment, lease term, and other critical details. Be sure to read the fine print!

- Mileage Limits: Most leases come with mileage restrictions, often set between 10,000 to 15,000 kilometers per year. Exceeding these limits can lead to hefty fees, so it’s crucial to be realistic about how much you’ll drive.

- Wear-and-Tear Rules: Leasing companies often have strict guidelines regarding the car’s condition when you return it. Regular maintenance is usually required, and any damage or excessive wear can incur additional charges.

- Insurance Requirements: You’ll need to have comprehensive insurance coverage on the leased vehicle, which can be an additional cost to factor into your budget.

Top Car Leasing Companies in Nigeria

In Nigeria, several companies specialize in car leasing, making it easier for first-time buyers to find a suitable vehicle:

- Coscharis Motors: Known for a wide range of vehicles, they offer flexible leasing options and excellent customer service.

- Leventis Motors: They provide various leasing plans and are well-regarded for their extensive network of service centers.

Both companies have a solid reputation in the market, but it’s always wise to read customer reviews and compare the terms they offer.

Pros and Cons of Leasing a Vehicle vs. Buying

Leasing has its benefits, but it’s essential to weigh them against the advantages of purchasing a car. Here are some pros and cons to consider:

Pros of Leasing:

- Lower Monthly Payments: Leasing typically requires a lower down payment and has lower monthly payments than buying, which can help keep your budget in check.

- Drive Newer Cars: Leasing allows you to drive a new car every few years without the worries of long-term ownership.

- Warranty Coverage: Many leases last as long as the manufacturer’s warranty, meaning fewer out-of-pocket expenses for repairs.

Cons of Leasing:

- No Ownership: At the end of the lease term, you have to return the car and will not have any equity in it. If you like the car, you can often buy it at the end of the lease, but it usually comes at a higher price.

- Mileage Limits: The restrictions on mileage can be a dealbreaker for some, especially if you plan to use the car for long trips or daily commuting.

- Potential Additional Costs: If the car has any damage or if you exceed the mileage limits, you might face extra fees that can add up quickly.

Ultimately, whether leasing or buying is the better option depends on your financial situation, driving habits, and personal preferences. Make sure to assess all aspects before making your decision.

Microfinance Bank Loans

For many first-time car buyers in Nigeria, securing financing can be a significant hurdle, especially if they have limited access to traditional banking services.

Microfinance banks provide a valuable alternative for those looking to purchase their first vehicle, especially for individuals from lower-income backgrounds or those without a strong credit history.

Let’s explore how these institutions operate and the benefits they offer.

How Microfinance Institutions Help First-Time Buyers

Microfinance institutions (MFIs) specialize in providing financial services to individuals and small businesses who may not qualify for traditional bank loans. They focus on empowering low-income earners and promoting financial inclusion.

For first-time car buyers, microfinance banks can offer smaller loan amounts with flexible repayment terms. They understand the unique challenges faced by lower-income earners and often tailor their services to meet these needs.

By offering accessible financing options, microfinance banks enable more individuals to own vehicles, which can improve their mobility and economic opportunities.

Best Microfinance Banks for Car Loans in Nigeria

Several microfinance banks in Nigeria have gained a reputation for their car loan products.

Here are two notable options:

- LAPO Microfinance Bank: LAPO is one of the largest microfinance banks in Nigeria, known for its focus on empowering low-income earners. They offer competitive car loan options with flexible repayment plans.

- Accion Microfinance Bank: Accion specializes in providing microfinance services that cater to small business owners and individuals. They offer tailored car loan products designed to meet the needs of first-time buyers.

Both institutions have established track records of serving their clients effectively and can be good starting points for your financing needs.

Interest Rates, Loan Limits, and Requirements

When considering a microfinance bank loan, it’s essential to understand the following:

- Interest Rates: Microfinance loans typically have higher interest rates compared to conventional bank loans, often ranging from 15% to 25% annually. However, these rates can vary based on the institution and your creditworthiness.

- Loan Limits: The amount you can borrow from microfinance banks may be lower than traditional banks, often ranging from ₦100,000 to ₦2,000,000, depending on your financial situation and the bank’s policies.

- Requirements: While requirements may vary by institution, common criteria include proof of income, a valid means of identification, and sometimes a guarantor. Some banks may also require that you open a savings account with them.

Advantages of Microfinance Loans for Lower-Income Earners

Microfinance loans offer several advantages for first-time buyers, especially those from lower-income backgrounds:

- Accessibility: Microfinance banks often have more lenient lending criteria, making it easier for first-time buyers without a strong credit history to secure financing.

- Flexible Terms: Many microfinance institutions provide flexible repayment terms, which can help borrowers manage their monthly payments more effectively.

- Financial Literacy: In addition to providing loans, many microfinance banks offer financial education programs to help clients understand how to manage their finances and make informed decisions regarding their loans.

- Community Support: Microfinance banks often have a community-oriented approach, providing support and resources to help borrowers succeed financially.

In summary, microfinance bank loans can be an excellent option for first-time car buyers in Nigeria, offering accessible financing solutions tailored to the needs of lower-income earners.

As with any financial decision, it’s crucial to conduct thorough research and compare options to find the best fit for your circumstances.

For more insights into financing your first vehicle, check out our guides on What First-Time Buyers Should Look for in a Car and The Pros and Cons of Buying New vs. Used Cars in Nigeria to explore additional and helpful insights.

Cooperative Societies and Community Financing

When it comes to financing your first car in Nigeria, cooperative societies can be an incredibly supportive option.

Many people may not realize that these organizations offer more than just savings and loans; they also foster community support and shared financial responsibility among members.

Let’s dive into how cooperative societies operate, the benefits they offer, and some key players in this space.

How Cooperative Societies Offer Financing for Members

Cooperative societies are member-owned organizations that provide various services, including savings and loan options.

In Nigeria, these societies operate based on the principle of mutual help and collaboration. Members pool their resources, allowing the society to offer loans at competitive rates.

When you join a cooperative society, you typically pay a membership fee and contribute to a common fund through regular savings.

Once you’ve built a certain level of savings, you can apply for a loan, which is often more accessible and less intimidating than seeking traditional bank financing. The loan amount and terms usually depend on your contribution and the society’s policies.

The Benefits of Using Community Financing Options

Community financing through cooperative societies has several advantages, particularly for first-time buyers:

- Lower Interest Rates: Interest rates on loans from cooperative societies are generally lower than those from commercial banks, making it a more affordable option for many borrowers.

- Flexible Terms: Many cooperative societies offer flexible repayment plans tailored to members’ financial situations, allowing for easier management of monthly payments.

- Supportive Environment: Being part of a cooperative means you’re in a community that encourages one another. Members often share experiences and advice on buying cars, maintenance, and financing options.

- Financial Literacy Programs: Many cooperatives also provide financial education and workshops, helping members understand budgeting, saving, and responsible borrowing.

- Easier Access: The lending criteria for cooperative societies tend to be more lenient than those of traditional banks, making them a great option for individuals without a solid credit history.

Key Cooperative Societies That Help Members Finance Cars

Several cooperative societies in Nigeria focus on providing car financing options. Here are a couple of noteworthy examples:

- Nigerian National Cooperative Federation (NNFC): This organization supports various cooperatives across the country and offers car loan schemes for members. They are well-known for their commitment to empowering communities through cooperative initiatives.

- Staff Cooperative Societies: Many organizations and companies have their own staff cooperative societies, which can offer loans to employees at lower rates. If you work for a large organization, check to see if they have a cooperative society that provides vehicle financing.

Understanding Loan Agreements, Terms, and Repayment Plans

Before you commit to financing through a cooperative society, it’s essential to understand the details of the loan agreement:•

- Loan Amount: This usually depends on your contributions to the cooperative. Members often receive loans that range from a few hundred thousand naira to several million, depending on their savings.

- Interest Rates: While generally lower than banks, the rates can vary between cooperatives. It’s crucial to ask about the rates and how they compare to other financing options.

- Repayment Plans: Cooperative societies often provide flexible repayment terms, typically ranging from 6 months to 5 years. You’ll want to ensure that the repayment schedule fits your budget.

- Collateral: Some cooperatives may require collateral for loans, such as the vehicle itself. Make sure you understand what is needed before taking out a loan.

- Default Consequences: It’s essential to be aware of the consequences of failing to meet repayment obligations. Many cooperatives have policies in place that can affect your membership status.

In summary, cooperative societies can be an excellent resource for first-time car buyers in Nigeria, offering accessible financing options and community support. If you’re considering this route, take the time to research and join a cooperative that aligns with your financial goals and needs.

Manufacturer Financing and Car Dealership Loans

When it comes to purchasing your first car in Nigeria, financing options offered directly by manufacturers and dealerships can be appealing for many first-time buyers. Understanding how these financing methods work can help you make an informed decision.

Let’s explore the various manufacturer financing options, the process of in-house dealership financing, and the benefits and drawbacks of each.

Manufacturer Financing Options from Popular Brands

Many car manufacturers provide financing programs designed specifically for their vehicles. This can be a great option for buyers who prefer to purchase new cars. For instance:

- Toyota Financial Services: Toyota often offers attractive financing deals, including low-interest rates and special incentives for new models. Their financing options are tailored to make owning a Toyota vehicle more affordable.

- Honda Financial Services: Honda also provides competitive financing rates and flexible payment plans, often including promotions for new car buyers. These programs can make it easier to drive away in a new Honda with manageable monthly payments.

- Nissan Finance: With various financing options, including loans and leases, Nissan Finance aims to meet the needs of first-time buyers. They frequently have promotional interest rates to encourage sales.

By opting for manufacturer financing, buyers may also have access to exclusive deals and promotions that are not available through traditional banks or financing institutions.

In-House Financing Through Car Dealerships: How It Works

In-house financing, or dealership financing, refers to the loans provided directly by car dealerships rather than through third-party lenders. Here’s how it generally works:

- Application Process: When you visit a dealership, you can apply for financing on-site. The dealership usually works with several lenders to provide financing options tailored to your credit profile and budget.

- Credit Check: The dealership will conduct a credit check to determine your eligibility for financing. Your credit score will influence the interest rate and loan terms you receive.

- Loan Offer: Once approved, the dealership will present you with financing offers. These can include different loan amounts, interest rates, and repayment terms.

- Signing the Agreement: If you accept an offer, you’ll complete the necessary paperwork to finalize the financing. The dealership typically handles all the administrative details, making the process more streamlined.

Low-Interest Dealership Loans and Flexible Payment Terms

One of the significant advantages of dealership financing is the potential for low-interest rates and flexible payment plans. Many dealerships offer promotional financing rates, especially on new models, which can make them competitive compared to traditional bank loans.

Additionally, dealerships may provide flexibility in payment terms, allowing buyers to choose a loan duration that suits their financial situation—whether that’s a short-term loan with higher monthly payments or a longer-term loan with lower monthly payments.

Benefits and Drawbacks of Financing Directly Through Dealerships

While dealership financing can be convenient, it’s essential to weigh its benefits and drawbacks:

Benefits:

- Convenience: Financing through the dealership allows for a one-stop shopping experience, where you can choose your car and finalize financing in one visit.

- Promotional Offers: Dealerships often have exclusive offers and incentives that can result in lower costs.

- Flexible Terms: Many dealerships are willing to work with buyers to create a repayment plan that fits their budget.

Drawbacks:

- Potentially Higher Rates: While some dealerships offer low rates, others may charge higher interest compared to banks, particularly if you have a less-than-stellar credit score.

- Limited Choices: The financing options presented may be limited to what the dealership has access to, potentially restricting your choices.

- Pressure Tactics: Some dealerships may pressure buyers into financing options that may not be in their best interest.

In conclusion, manufacturer financing and dealership loans can be viable options for first-time car buyers in Nigeria. By understanding how these financing options work, you can make a more informed decision that best fits your needs and budget.

For more insights into financing options, check out our sections on Bank Loans for Car Financing and Hire Purchase Financing to explore a broader range of ways to finance your first vehicle.

Peer-to-Peer Lending and Other Alternatives

For first-time car buyers in Nigeria, exploring alternative financing methods beyond traditional bank loans can open up new avenues for funding a vehicle purchase.

Peer-to-peer (P2P) lending and other innovative financing options are becoming increasingly popular, offering flexibility and accessibility.

In this section, we will examine how P2P lending works, alternative financing methods, and the associated risks and rewards.

Explanation of Peer-to-Peer Lending Platforms

Peer-to-peer lending connects individual borrowers with lenders through online platforms, bypassing traditional financial institutions.

In Nigeria, platforms like KiaKia and Carbon are leading the charge in providing accessible financing options for consumers:

- KiaKia: This platform facilitates quick loan approvals by connecting borrowers with lenders willing to fund their requests. Users can apply for loans online, making it a convenient option for first-time buyers looking for immediate funding.

- Carbon: Carbon offers a seamless lending experience with flexible repayment plans. Users can easily apply for loans via their mobile app or website, with decisions typically made within minutes. Carbon also allows for quick access to funds, making it an attractive option for those in need of immediate financial assistance.

How P2P Lending Works and What First-Time Buyers Should Consider

P2P lending operates on a straightforward model:

- Loan Request: Borrowers submit a loan request on the platform, detailing the amount needed and the purpose of the loan (e.g., purchasing a car).

- Matching Process: The platform matches borrowers with individual lenders who can fund their loan requests.

- Funding and Approval: Once a lender agrees to fund the loan, the borrower receives the money, which can be used to purchase the vehicle.

- Repayment: Borrowers repay the loan in installments over an agreed-upon period, with interest rates typically set by the platform based on the borrower’s creditworthiness.

Before opting for P2P lending, first-time buyers should consider the following:

- Interest Rates: While P2P platforms may offer competitive rates, it’s essential to compare them with traditional bank loans to ensure you’re getting a fair deal.

- Loan Limits: Check the maximum loan amounts available, as these may vary between platforms and could impact your purchase options.

- Repayment Terms: Understand the repayment structure, including any fees for late payments or early repayment.

Alternative Financing Options: Crowdfunding and Digital Loan Apps

In addition to P2P lending, there are other alternative financing methods worth exploring:

- Crowdfunding: Platforms like GoFundMe allow users to raise money for personal projects, including car purchases. While this method relies on donations from friends, family, and strangers, it may not guarantee sufficient funds for a vehicle.

- Digital Loan Apps: Several mobile apps offer quick loans with minimal documentation requirements. These apps typically provide small loan amounts that can be used towards a car purchase. Popular options include PalmPay and FairMoney, which allow users to apply for loans directly from their smartphones.

Risks and Rewards of Using Non-Traditional Car Financing Methods

While alternative financing options like P2P lending and crowdfunding offer unique benefits, they also come with inherent risks:

Rewards:

- Accessibility: P2P platforms often provide loans to individuals who may not qualify for traditional financing due to limited credit history.

- Quick Approval: The online application process typically results in faster approvals, allowing for quicker access to funds.

- Flexibility: Many alternative financing options offer flexible terms, allowing borrowers to choose repayment plans that fit their budget.

Risks:

- Higher Interest Rates: Some P2P platforms may charge higher rates than traditional banks, especially for borrowers with lower credit scores.

- Scams and Fraud: As with any online platform, borrowers should be cautious of scams. It’s essential to research the platform’s reputation and user reviews before proceeding.

- Debt Accumulation: Relying on alternative financing methods can lead to accumulating debt if borrowers do not manage their finances carefully.

In summary, peer-to-peer lending and other alternative financing methods can be valuable options for first-time car buyers in Nigeria. By understanding how these platforms work and weighing the associated risks and rewards, you can make informed decisions that best fit your financial situation.

For more information on financing options, consider checking out our sections on Bank Loans for Car Financing and Hire Purchase Financing for a comprehensive view of available methods.

Conclusion

Financing a car can be overwhelming for first-time buyers, but Nigeria offers a variety of options to fit different financial situations.

Whether you opt for a traditional bank loan, lease, or explore hire purchase agreements, understanding the terms and making informed decisions will help you get behind the wheel.

Evaluate your budget, future expenses, and loan terms carefully before committing to any financing plan.

Happy car shopping!