Buying your first SUV is an exciting milestone, but the price tag can be overwhelming. Thankfully, there are numerous financing options available in Nigeria to make your dream a reality.

Whether you are considering auto loans, leasing, or hire purchase, understanding the terms and conditions is essential for a smart financial decision.

In this guide, we will break down the best SUV financing options for first-time buyers, including tips on securing low-interest rates and choosing the right plan for your budget.

Why Financing an SUV is a Smart Choice for First-Time Buyers

Buying your first SUV can be a daunting financial commitment, but financing offers a flexible and manageable way to make your dream car a reality.

With the right plan, financing not only makes vehicle ownership accessible but also offers several long-term benefits.

Here’s why financing could be the perfect option for first-time buyers.

1. Reduces the Financial Burden of Upfront Payments

Let’s be real — SUVs aren’t cheap. Paying for one upfront can drain your savings, leaving you little room for other financial priorities.

Financing allows you to spread the cost over several months or years, reducing the initial payment and making it less overwhelming.

For example, instead of parting with ₦40 million at once for a new Toyota Prado, you can pay an initial deposit and break the rest into smaller installments that fit your budget. This way, you don’t sacrifice your financial stability.

2. Allows Buyers to Own Their Dream Vehicle Sooner

Financing lets you drive away in the SUV you have always wanted without waiting years to save up the full amount.

Imagine needing a reliable car for your growing family or business — financing ensures you get a practical solution sooner rather than later.

Plus, you don’t have to settle for a subpar vehicle because of budget constraints. You can opt for the latest features, safety technologies, and comfort without compromising on quality.

3. Flexible Payment Plans Tailored to Various Income Levels

Many financial institutions and car dealerships in Nigeria offer customized payment plans. Whether you’= are a young professional or a small business owner, there is likely a plan that aligns with your income and spending habits.

Some plans offer longer repayment periods with lower monthly payments, while others focus on short-term commitments to minimize interest. Either way, you can find a financing solution that works for you.

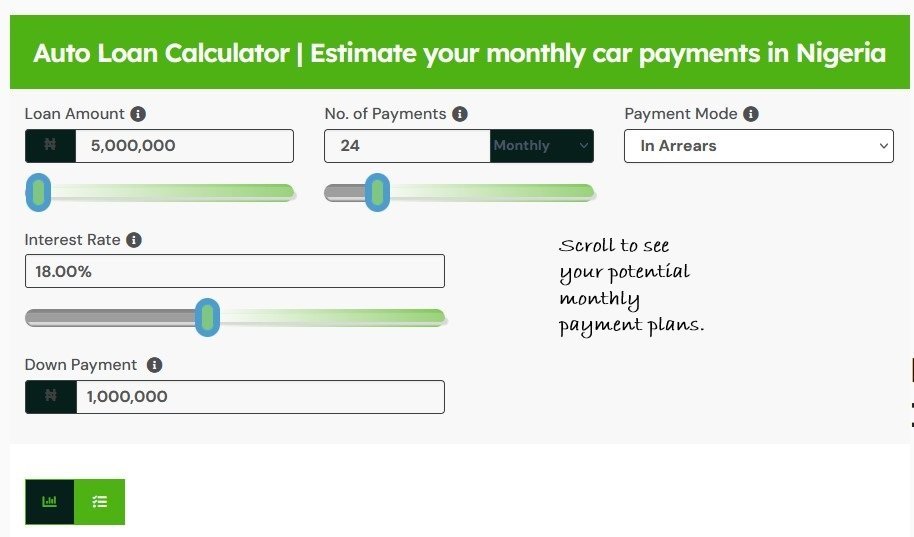

Before you commit to any loan offer, check out how your monthly payments could look using our Auto Loan Calculator.

4. Builds Financial Discipline and Credit History

If you have never had a loan before, financing your first SUV is an excellent way to build credit.

By making regular, on-time payments, you demonstrate financial responsibility, which can help you secure better loan terms for future purchases, like a house or business investment.

It also instills financial discipline. You’ll need to budget effectively and prioritize repayments, which are valuable life skills.

Things to Consider Before Financing

While financing is a great option, there are a few things you should evaluate:

- Interest Rates: Ensure you understand the total cost, including interest, before signing an agreement.

- Hidden Fees: Ask about processing fees, insurance, and other charges that might come with the loan.

- Your Income Stability: Be honest about your ability to commit to monthly payments without strain.

Final Thoughts

Financing an SUV is not just about affordability — it’s about making a smart financial decision that aligns with your lifestyle and future goals.

With reduced upfront costs, flexibility, and the chance to build credit, financing makes SUV ownership more accessible than ever for first-time buyers.

By making informed choices and weighing the options, financing an SUV can turn what feels like a distant goal into an attainable milestone.

SUV Financing Options in Nigeria

Purchasing an SUV in Nigeria can be a significant investment, but there are several financing options available to make the process more accessible and affordable.

From bank loans to manufacturer financing, understanding these options will help you choose the best fit for your budget and lifestyle.

1. Auto Loans from Banks

Auto loans are one of the most common financing options in Nigeria, offered by major banks.

Features

- Loan Tenure: Typically ranges from 12 to 60 months.

- Interest Rates: Vary between 10–30%, depending on the bank and loan terms.

- Repayment Schedules: Fixed monthly installments over the agreed loan period.

Common Banks Offering Auto Loans

- GTBank: Known for flexible repayment options and competitive interest rates.

- Access Bank: Offers auto loans tailored to salaried individuals and business owners.

- Zenith Bank: Provides both personal and business auto loans with attractive terms.

Requirements

- Proof of income or employment.

- Good credit history.

- Down payment (usually 10–30% of the car’s value).

- Valid identification and proof of residence.

2. Manufacturer Financing Programs

Some car manufacturers partner with financial institutions to offer tailored financing options.

Popular Options

- Toyota Nigeria: Provides financing plans with lower interest rates and exclusive offers.

- Hyundai Motors Nigeria: Offers financing for new SUVs like the Tucson or Santa Fe through local partners.

- Kia Motors Nigeria: Features affordable payment plans for popular models like the Sportage.

Benefits

- Lower interest rates than traditional bank loans.

- Exclusive offers, such as free servicing or extended warranties.

- Faster approval processes.

3. Leasing Options

Leasing is a flexible alternative to buying, where you essentially rent the vehicle for a specific period.

Pros

- Lower monthly payments compared to purchasing.

- No long-term commitment, making it ideal for short-term needs.

Cons

- Mileage limits, often restricting long-distance travel.

- Higher overall costs if you decide to buy the car after the lease ends.

Ideal For

Business owners or individuals who want to avoid the responsibilities of ownership while still using an SUV for work or leisure.

4. Hire Purchase Agreements

Hire purchase agreements allow you to own the SUV after completing a series of installment payments.

How It Works

- You make an initial deposit.

- Regular monthly payments are made over a set period.

- Ownership is transferred to you upon completing all payments.

Benefits

- No stringent credit score requirements, making it accessible to more buyers.

- Flexible payment terms based on your income.

Drawbacks

- Higher total costs due to interest charges.

Final Thoughts

Each financing option offers unique benefits and challenges, so it’s important to assess your financial situation, long-term goals, and the SUV model you are interested in before making a decision.

By exploring these options, SUV buyers in Nigeria can find a financing method that aligns with their needs and financial capacity.

Key Factors to Consider When Choosing a Financing Option

Selecting the right financing option for your SUV can significantly impact your overall cost and financial stability. Here are the key factors to evaluate before making a decision:

1. Interest Rates

Fixed vs. Variable Rates

- Fixed Rates: Interest remains constant throughout the loan tenure, making it easier to budget for monthly payments.

- Variable Rates: Interest fluctuates based on market conditions, potentially leading to lower or higher costs over time.

Impact on Costs

- A lower interest rate reduces the overall cost of the loan. Compare rates from banks, manufacturers, and leasing companies to find the best deal.

Before you commit to any loan offer, check out how your monthly payments could look using our Auto Loan Calculator.

2. Down Payment

Ideal Percentage

- A higher down payment (20–30% of the car’s value) reduces the principal amount, resulting in lower monthly installments and less interest over time.

Benefits of a Larger Down Payment

- Increases the chances of loan approval.

- Minimizes the total cost of the loan.

3. Loan Tenure

Short-Term vs. Long-Term Plans

- Short-Term: Higher monthly payments but lower total interest paid over time. Ideal for those with a stable income.

- Long-Term: Lower monthly payments but higher overall costs due to extended interest accrual. Suitable for buyers with limited immediate funds.

Finding the Right Balance

Choose a tenure that aligns with your monthly income while minimizing the overall cost.

4. Hidden Fees

Common Hidden Costs

- Insurance Fees: Often mandatory, adding to the loan amount.

- Administrative Costs: Charged for processing the loan application.

- Early Repayment Penalties: Fees for paying off the loan before the agreed term ends.

Tips to Avoid Surprises

- Read the loan agreement carefully to identify any hidden charges.

- Ask for a breakdown of all associated costs before signing.

Final Thoughts

Evaluating these factors ensures you choose a financing option that suits your budget and long-term financial goals. It’s essential to research and compare offers from multiple lenders to make an informed decision.

Tips for Securing the Best SUV Financing Deal

Finding the most cost-effective financing option can save you money and make SUV ownership more manageable. Here are some actionable tips to help you secure the best deal:

1. Compare Offers from Multiple Banks and Lenders

- Why It’s Important: Different banks and financial institutions offer varying interest rates, loan tenures, and repayment terms.

- How to Do It:

- Gather quotes from at least three banks or lenders.

- Check the annual percentage rate (APR) to assess the true cost of the loan.

- Consider online auto loan marketplaces for easy comparisons.

Want to compare financing options between multiple banks or lenders? Plug each car’s price into our Auto Loan Calculator and see which fits your budget best.

2. Negotiate Interest Rates and Loan Terms

- Why It’s Important: Many lenders are open to adjusting rates and terms, especially if you have a strong credit history.

- Tips:

- Highlight competitive offers from other lenders to encourage better deals.

- Negotiate for a lower interest rate or waive administrative fees.

- Ask about early repayment options to avoid penalties.

3. Improve Your Credit Score for Better Offers

- Why It’s Important: A higher credit score often results in lower interest rates and better loan terms.

- Steps to Take:

- Pay off outstanding debts and credit card balances.

- Ensure timely payments for utility bills and existing loans.

- Review your credit report for errors and dispute inaccuracies.

4. Save for a Substantial Down Payment

- Why It’s Important: A larger down payment reduces the principal loan amount, leading to lower monthly payments and interest costs.

- Target: Aim for at least 20% of the SUV’s price.

- Bonus: It also increases your chances of loan approval.

5. Opt for Pre-Owned SUVs for Lower Financing Costs

- Why It’s Important: Used vehicles generally have lower purchase prices, requiring smaller loans.

- Tips for Pre-Owned Financing:

- Verify the vehicle’s history using platforms like AutoCheck or Carfax.

- Look for certified pre-owned (CPO) SUVs to ensure quality and reliability.

- Confirm if your lender offers lower rates for pre-owned vehicles.

Final Thoughts

Securing the best SUV financing deal requires research, preparation, and strategic decision-making. By comparing lenders, negotiating terms, and improving your financial standing, you can significantly reduce the cost of owning your dream SUV.

| Bank / Lender | Interest Rate / APR | Tenure (months) | Min. Equity Contribution | Max. Loan Amount |

|---|---|---|---|---|

| Polaris Bank | 0% p.a. for 4 months, then 25 % p.a. | 60 (4‑month intro + 56) | Not specified | Not specified |

| UBA | Approx. 20 % p.a. | Up to 48 | 30 % | ₦15 million |

| FCMB Standard Auto Loan | As low as 33.5% p.a. | 12–60 | 20 % | ₦0.5–30 million |

| FCMB – GAC/JAC promo | (Likely same ~33.5%) | Up to 60 | — | — |

| First Bank of Nigeria | “Highly competitive” (no rate given) | Up to 48 | 30 % | ₦20 million |

| Access Bank | “Competitive” (no exact rate) | Up to 48 | 10 % | ₦70m (used) / ₦200m (new) |

| Credit Nigeria summary | APR range 46.8 – 108 %, tenure 3–24 months | 3–24 | — | — |

Common Mistakes to Avoid When Financing Your First SUV

When financing your first SUV, it’s easy to make errors that can have long-term financial consequences. Here is how to steer clear of these common pitfalls:

1. Overestimating Your Budget and Choosing an Expensive SUV

- Why It’s a Mistake: Overstretching your budget can lead to financial strain and difficulty meeting monthly payments.

- How to Avoid It:

- Calculate your monthly income and expenses to determine a realistic budget.

- Use an online car loan calculator to estimate monthly payments, including interest.

- Factor in additional costs like insurance, fuel, and maintenance.

2. Ignoring the Fine Print in Financing Agreements

- Why It’s a Mistake: Hidden fees, unfavorable terms, or penalties for early repayment can increase the total cost of financing.

- How to Avoid It:

- Carefully review the loan agreement before signing.

- Ask for clarification on terms like interest rate (fixed vs. variable), loan tenure, and hidden charges.

- Consult a financial advisor or lawyer if necessary.

3. Skipping Insurance Requirements, Which Increase Risks

- Why It’s a Mistake: Driving without adequate insurance exposes you to high repair costs and liability in accidents.

- How to Avoid It:

- Ensure the SUV is covered by comprehensive insurance, not just third-party liability.

- Check if your lender requires insurance as part of the loan agreement.

- Compare insurance plans from different providers to get the best coverage at an affordable price.

4. Defaulting on Payments and Damaging Your Credit Score

- Why It’s a Mistake: Missing payments can lead to penalties, repossession of the vehicle, and a lower credit score.

- How to Avoid It:

- Set up automatic payments or reminders for due dates.

- Stick to a manageable loan tenure and monthly repayment plan.

- Communicate with your lender if you anticipate difficulties in making payments.

Final Thoughts

Avoiding these common financing mistakes can help you enjoy your first SUV without financial stress. By planning carefully, understanding loan terms, and managing payments, you’ll be on the road to successful ownership.

Conclusion

Financing your first SUV doesn’t have to be stressful. By exploring options like bank loans, leasing, and manufacturer programs, you can find a plan that suits your financial needs and lifestyle.

Remember to do your research, negotiate where possible, and avoid common pitfalls to make your SUV ownership journey smooth and enjoyable.

Need more clarification, our post on Buying Your First SUV: Nigerian Guide to Choosing the Perfect Vehicle (2025) and How to Get Approved for a Car Loan as a First-Time Buyer in Nigeria will provide you with detailed information to make informed decision.

Ready to take the wheel? Start by comparing your financing options today!